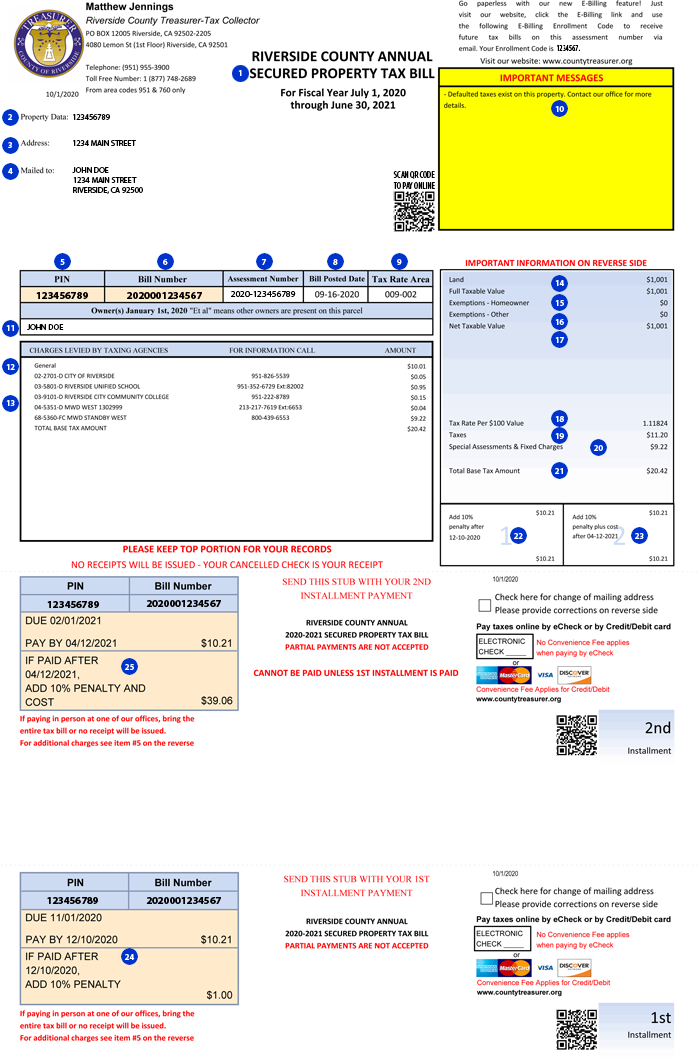

Current Secured tax bill sample

Please scroll down to the bottom of the page for a brief explanation of each item identified on the image below.

1. Type of Bill: This section will indicate the type of bill you have received.

a. Secured or Unsecured

b. An Annual tax bill from a prior year

c. Unpaid tax bill from a prior year

d. A delinquent tax bill

e. A corrected tax bill

2. Property Data: Assessor’s parcel number (APN), legal description or portion of legal description.

3. Address: This is the situs or physical address of the property (if no postal address this may be blank).

4. The mailing address where tax bill is mailed according to the records with the County Assessor’s office.

5. PIN number: This is the Primary Identification Number of the property that is being taxed.

6. Bill Number: Unique tax bill number assigned to your property each year.

7. Assessment number: Unique number to identify the specific assessment that has been assessed against a PIN covering a specific range of time, resulting in this bill.

8. Bill Posted Date: This is the date that the tax bill was created on our system.

9. Tax Rate Area: The Auditor-Controller groups taxable properties into tax Rate Areas (TRAs). The TRAs are numbered and appear on both secured and unsecured tax bills.

10. Contains important details regarding your account such as defaulted taxes and lien filing. Please contact our office for further information.

11. Owner(s) January1, 2020: This will list the owner(s) on record on January 1, per the Assessor's records- This will only list owners as space allows.

12. Ad Valorem Special Assessments are voter approved taxes.

13. Special assessments placed on the tax bill at the direction and by the authority of taxing agencies. This area shows a breakdown of your tax bill by agency receiving tax dollars. If you have any questions regarding the tax amounts, contact them directly using the telephone numbers listed.

14. Taxable values of your property as of January 1st – Land, Structure, Trade Fixtures, Trees & Vines, etc… as determined by the County Assessor – for questions regarding values contact their office at (951) 955-6200.

15. Full Taxable Value: Sum of taxable values - this is the taxable value before any applicable Exemptions are applied.

16. Exemptions: Any Exemptions applied by Assessor will be shown here. For questions regarding exemptions or further explanation, please contact the County Assessor at (951) 955-6200.

17. Net taxable value: This is the total of Assessed value less the total of Exemptions, if applicable.

18. A factor derived by combining the 1% limit plus the Ad Valorem Special Assessment rates.

19. Taxes: amount due for taxes not including Special Assessments & Fixed Charges.

20. Special Assessments & Fixed Charges: Sum of Special Assessments and Fixed charges a described in Item #13.

21. Total Base Tax Amount: The total tax amount due for the entire tax year, including the first and second installment.

22. First Installment amount is due November 1st no later than December 10th (*if delinquent date falls on a Saturday, Sunday or legal holiday, the delinquent date is the next business day).

23. Second Installment amount is due February 1st no later than April 10th (*if delinquent date falls on a Saturday, Sunday or legal holiday, the delinquent date is the next business day).

24. First installment penalty of 10% if paid after the delinquency date of December 10th.

25. Second Installment penalty of 10% plus cost if paid after delinquency date of April 10th.